Ready to grow your business outside of the U.S.? Exporting can be lucrative but also risky. Check out this HOW TO GUIDE for navigating the water of international business.

(Blog provided by ThomasNet.com and author Kristin Manganello.)

The global export market presents U.S. companies with a wealth of opportunities. However, just like with any large-scale opportunity, expanding your international presence also exposes you to a number of vulnerabilities and challenges, some of which stem from factors beyond your control.

In a world plagued by uncertainties, being aware of the possible risks and knowing how to mitigate them is one of the most important investments a company can make when considering exported goods.

Below are a few examples of common risks businesses must be prepared to handle when exploring international trade opportunities.

Types of Risk in International Business

Credit Risks

While credit problems present unavoidable risks in both domestic and foreign markets, they are significantly trickier when it comes to international trade simply due to the fact that international business is more complex than domestic business. The biggest credit risk when it comes to exporting is a buyer’s inability to pay.

One of the best defenses you have against the risk of non-payment is to invest in government-issued export credit insurance (ECI). According to the International Trade Commission, a subset of the U.S. Department of Commerce, “ECI significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay.”

Currency Exchange Risks

Exchange rates often fluctuate and, as a result, create an erratic financial landscape for exporters. While some export contracts include terms that guarantee all transactions will be calculated in U.S. dollars, this is not always the case, nor is it always possible.

The main risk that exporters face is the depreciation of foreign currencies. For example, if you’re exporting your product to a European market, and your contract is denominated in euros, equaling out to €100,000. At the time of the contract signing, one euro is equal to $1.20, meaning, at that exchange rate, your company receives $120,000 after conversion.

However, let’s also say that, between the time of contract signing and delivery of goods, the euro depreciates slightly – instead of being equal to one American dollar, the euro now equals $1.16, resulting in your company only receiving $116,000 after conversion for the same amount of goods.

Some export risk insurances offer exchange rate risk coverage, as do some banks and brokers. There are also several options that can reduce exchange risks, including negotiating for cash in advance, utilizing foreign currencies to pay for foreign services or supplies, or working with your buyer to establish an agreed-upon exchange rate in advance.

Political Risks

Shifting social and political situations in importing and exporting countries, such as changes of power, social upheaval, and bankruptcy, can have substantial impacts on international business operations. Foreign governments may also suddenly expropriate a company’s assets or enact abrupt restrictions on conversions.

The best way to manage political situations is to exercise due diligence, thoroughly researching and analyzing a country’s political climate. While many businesses assess the international climate before deciding to export, this investigative approach should really be applied before, during, and even after a market has been identified.

There are several tools that are useful for keeping your finger on the pulse of international landscapes, including Moody’s Investor Services and Analytics, the Global Economy, the International Country Risk Guide from the PRS Group, among others.

Supply Chain Risks

Just like with credit risk, supply chain risks are inherent in both domestic and foreign markets. However, because the global market is so vast, complex, and fragmented, supply chain risks are multiplied exponentially when exporting.

Not only are there risks associated with the logistics of getting your product from point A in the U.S. to point B in your targeted international market, but there are innumerable risks stemming from theft, damage, loss, natural disasters, and compliance issues.

Being proactive about your supply chain risk mitigation tactics is essential, and researching the best export and logistical practices for your specific product and market is a good place to start. From there, you can draft and document a strong set of procedures to employ during the exporting process; these procedures should also include contingency plans for handling situations like natural disasters.

And when it comes to the unpredictable world of global compliance, it’s prudent to consult with a third party that specializes in this specific subject. There are many layers of compliance, regulations, and other forms of bureaucratic standards that can entangle your company’s profitability and threaten its bottom line – having an export managing partner can greatly reduce the number of risks brought about by compliance issues.

Distribution Risks

Even if everything else goes smoothly, there is still the risk that your product will not perform well in your chosen overseas market, especially if you’ve chosen to adopt a direct exporting model and forego using an export management company.

Although direct exporting methods offer some advantages, they also require more time and effort on your end. As the sole contact point in a direct exporting model, you’re expected to be available for customer communications at all times and handle all aspects of logistics. This can be tricky, especially if you’re unfamiliar with a country’s cultural nuances.

One way to get around distribution risks is to adopt an indirect exporting model; this approach is based on developing a relationship with an export management company that can dedicate its time solely to the export aspect of your business. Forging a partnership with a company that understands the ins-and-outs of a particular country can help you identify the best potential markets, distribution channels, and logistical details for your product.

Forfaiting Services

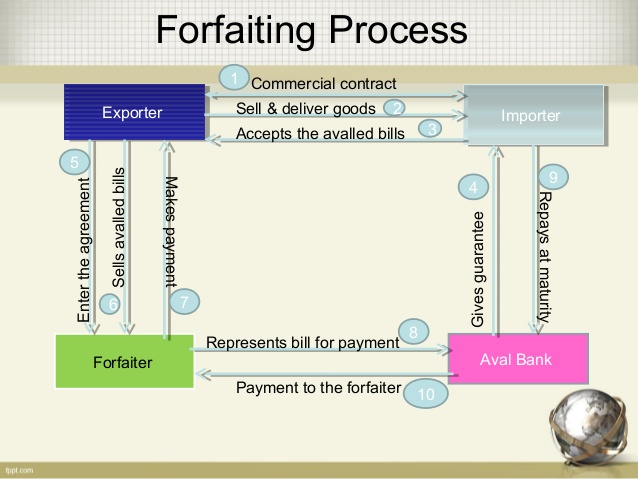

To mitigate various types of risks, exporters may choose to utilize a third party to provide forfaiting services. Forfaiting is the sale of an exporter’s medium and long term-term receivables (debts owed for delivered goods) at a discount in exchange for a lump sum payment shortly after delivery.

The financial arrangement is made on a “without recourse” basis; the exporter has no liability stemming from the importer’s possible default on the debt. The payment obligation is often supported by the importer’s bank guarantee.

Key Features of Forfaiting

- Intended for export of capital goods, commodities, and large projects

- $100,000 minimum transaction size

- Typical credit period of 180 days to 7 years or more

- Forfaiter assumes all risks of non-payment

- Contracts settled within hours or days

- Simple documentation

Benefits of Forfaiting

In addition to a near-immediate payment upon delivery, there are several other aspects of forfaiting that make it attractive – mainly that it eliminates many trade risks.

Exporters are protected when transacting business in countries where political and economic conditions threaten trade. Currency exchange rate fluctuations risks are borne by the forfaiter as well. These protections allow the exporters to broaden their markets by conducting business in countries that may have otherwise gone unserved. The availability of financing to the importer is another aspect of forfaiting that helps increase the market share.

Accounting advantages include an increased cash flow by converting the typically credit-based transaction into a cash transaction. The balance sheet is simplified by eliminating accounts receivable and bank loans. Although the cost is typically higher than commercial lender financing, the additional cost is often added to the exporter’s standard pricing.